Sustainable Finance in Aviation: A New Era for Airports

As the aviation industry faces increasing pressure to reduce its environmental impact, airports are at the forefront of implementing sustainable practices that not only benefit the planet but also impact financial decisions and investments.

The Growing Importance of Sustainability in Airport Operations

Airports around the world are recognizing the critical need to incorporate sustainable practices into their operations. This shift is driven by a combination of factors, including:

- Increasing regulatory pressure to reduce carbon emissions

- Growing public awareness and demand for eco-friendly travel options

- Long-term cost savings associated with energy-efficient technologies

- Competitive advantage in attracting environmentally conscious airlines and passengers

Financial Implications of Sustainable Practices

The adoption of sustainable practices in airport operations has significant financial implications:

Initial Investments

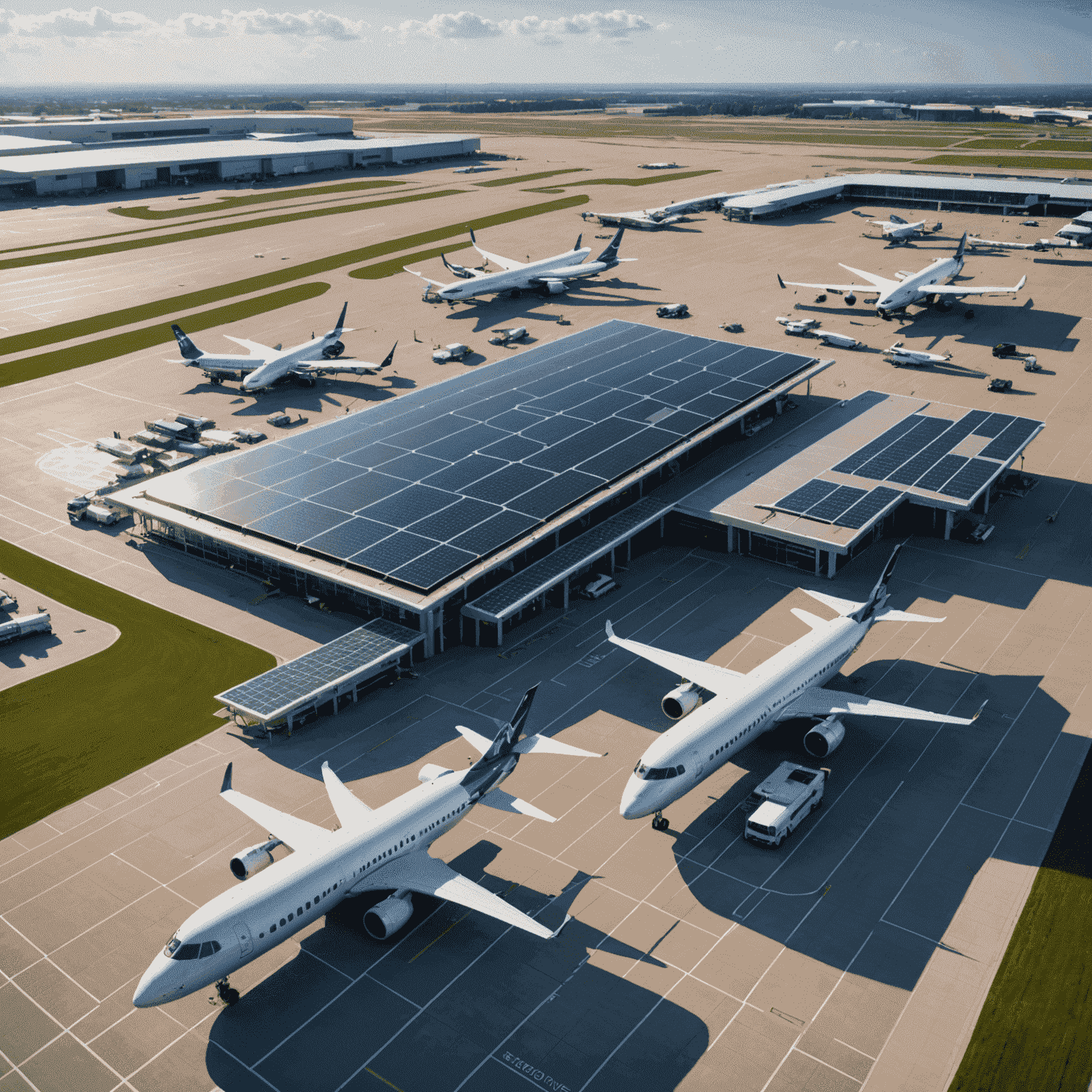

Implementing sustainable technologies often requires substantial upfront costs. Airports are investing in:

- Solar panel installations

- Energy-efficient lighting systems

- Electric vehicle charging infrastructure

- Waste management and recycling facilities

Long-term Savings

Despite initial costs, sustainable practices lead to significant long-term savings through:

- Reduced energy consumption

- Lower maintenance costs

- Decreased reliance on fossil fuels

- Improved operational efficiency

Impact on Investment Decisions

The focus on sustainability is reshaping investment strategies in the aviation sector:

- Green Bonds: Airports are increasingly issuing green bonds to finance sustainable projects, attracting environmentally conscious investors.

- ESG Criteria: Environmental, Social, and Governance (ESG) factors are becoming crucial in investment decisions, with sustainable airports seen as more attractive prospects.

- Innovation Funding: There's a growing pool of capital dedicated to funding innovative sustainable technologies in aviation.

- Risk Mitigation: Investors view sustainable practices as a way to mitigate long-term risks associated with climate change and regulatory changes.

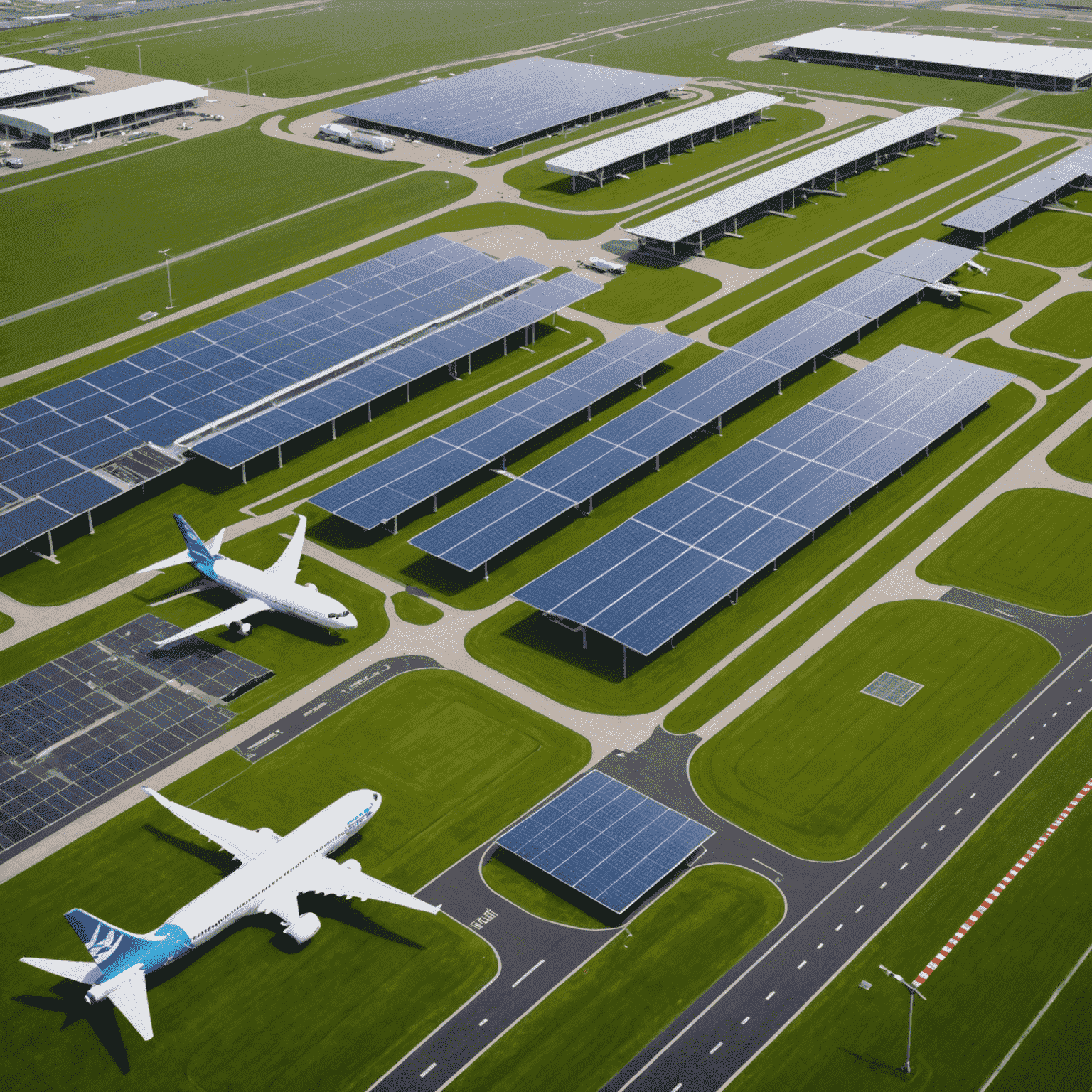

Case Study: Amsterdam Airport Schiphol

Amsterdam Airport Schiphol serves as an excellent example of how sustainable practices can be successfully integrated into airport operations:

- 100% powered by renewable energy since 2018

- Implemented circular economy principles in terminal construction

- Introduced sustainable aviation fuel (SAF) for airlines

- Issued €500 million in green bonds to finance sustainability projects

The Future of Sustainable Finance in Aviation

As the aviation industry continues to evolve, sustainable finance will play an increasingly crucial role in shaping the future of airports:

- Integration of sustainability metrics into financial reporting and valuation models

- Development of new financial instruments tailored to sustainable aviation projects

- Increased collaboration between airports, airlines, and investors to drive sustainable innovation

- Potential for government incentives and subsidies to accelerate sustainable transitions

In conclusion, the growing importance of sustainable practices in airport operations is fundamentally changing the financial landscape of the aviation industry. As airports continue to invest in eco-friendly technologies and processes, they are not only contributing to a greener future but also positioning themselves for long-term financial success in an increasingly sustainability-focused world.